estate tax return due date canada

Canadian Fixed Due Dates. For more information go to Guide T4013 T3 Trust Guide.

Money Dates 2018 Dating Personals How To Plan Money

If you fail to file the T3 return by the due date you will be subject to a penalty.

. Unlike the filings of the year preceding death. For example if your loved one owned a rental property purchased in 1995 for 200000 that was worth. For a T3 return your filing due date depends on the trusts tax year-end.

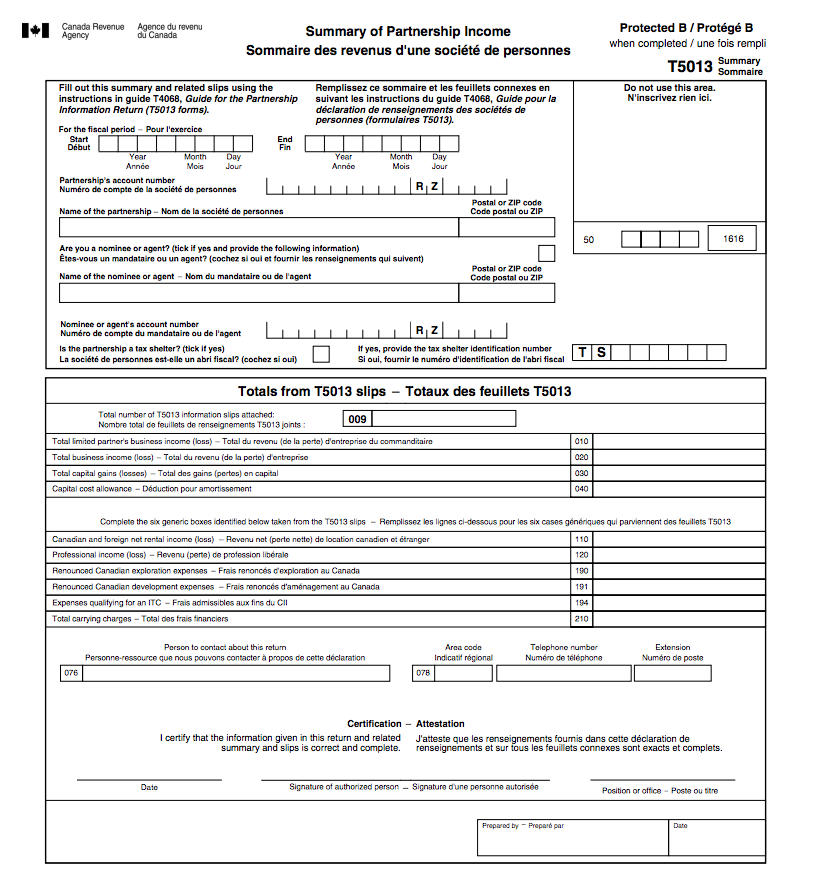

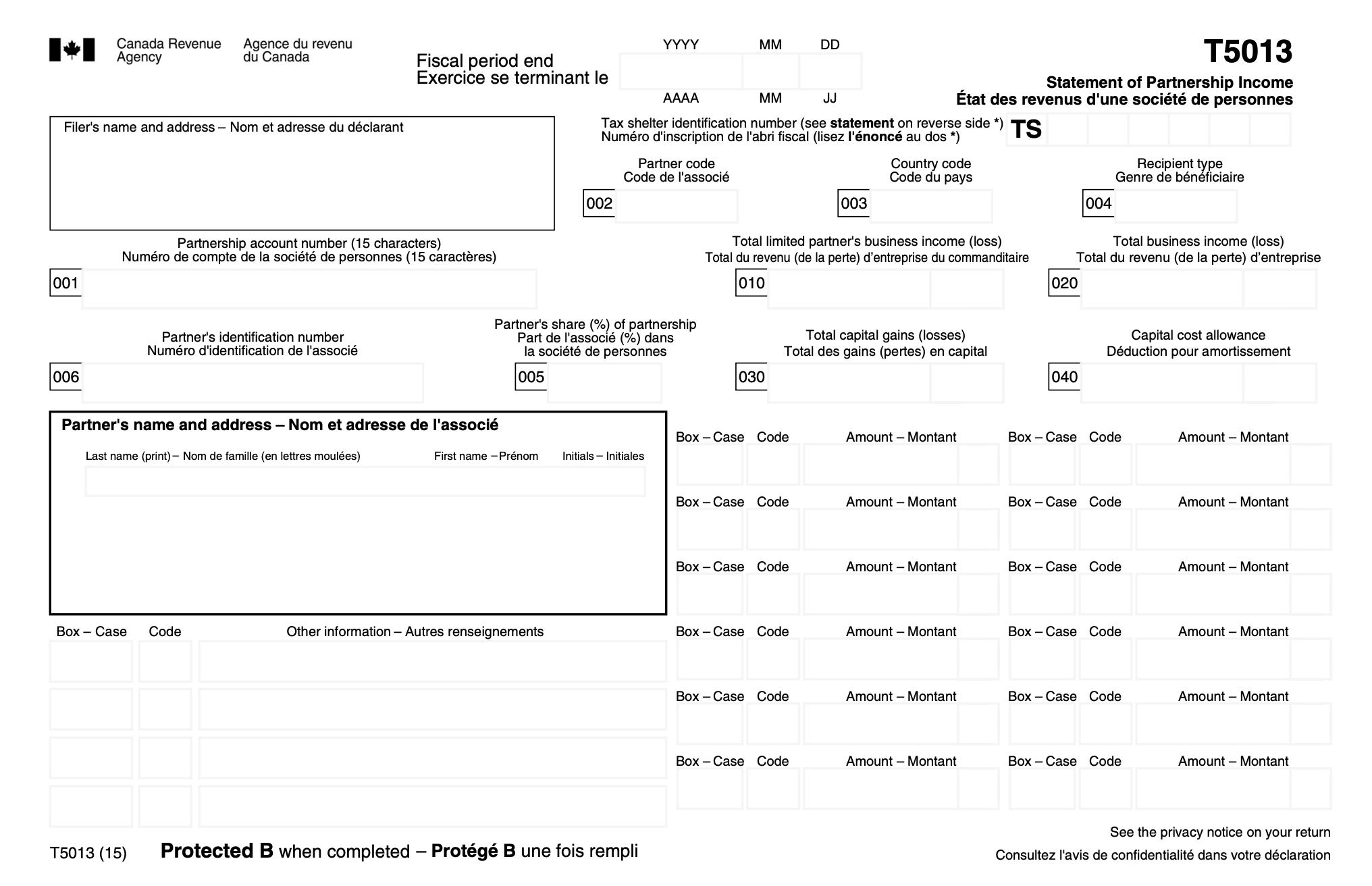

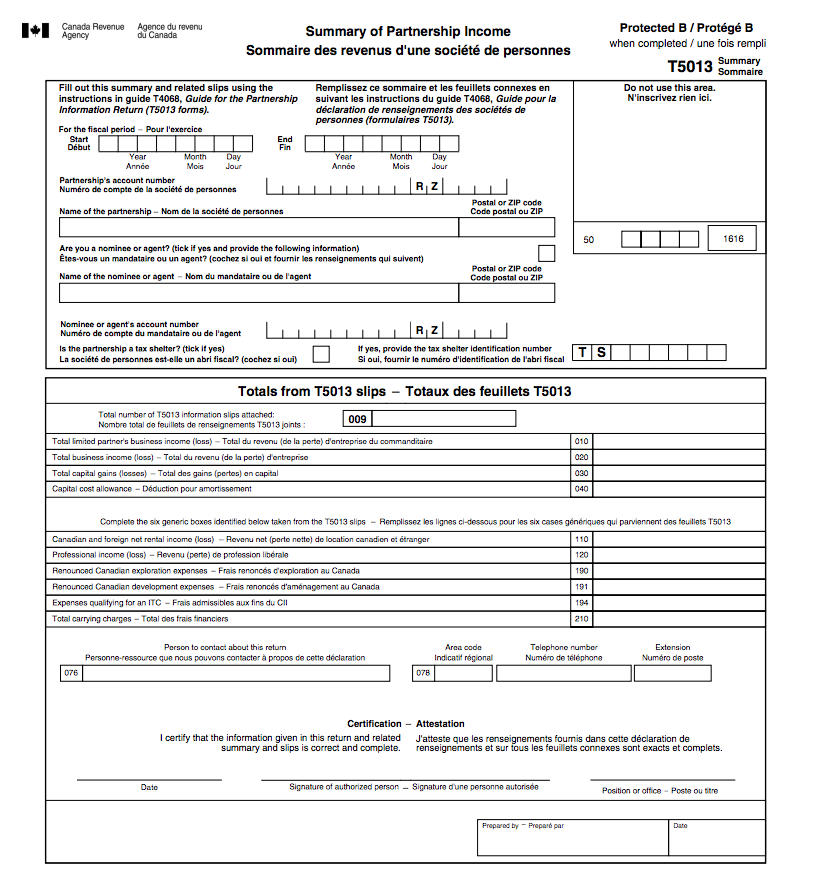

When Can I File My Taxes 2022 Tax Filing Deadline 2022 Turbotax Canada Tips T5013 A Simple Guide To. 1 1 309 Reply. On Form 1041 US you need to file a tax return.

Estate tax return due date canada Friday February 25 2022 Edit. 5 for each 1000 or part thereof of the first 50000 of the value of the estate. 20000 x 135365 1849315 to be reported on the final return.

Estate Tax Return due date extended too. If the death occurred between November 1 and December 31 inclusive the due date for the final return is 6 months after the date of death. If the filing due date falls on a saturday a sunday or a public holiday recognized by the cra we will consider it filed on time if it is delivered on or postmarked.

A capital gain is when an asset goes up in value when it is sold. In that case the due date for filing the 2021 T1 return of a surviving spouse or common-law partner who was living with the deceased is the same as the due date for the deceaseds 2021. The other optional Returns such as Return for a Partner or Proprietor and the Return of Income from a Graduated Rate Estate are due on the same date as the final return.

February 28 T4 and T5 filing deadline. If the deceased or the deceaseds spouse or common-law partner was. Unfortunately it is only the 1040 series that have been extended.

To get a clearance certificate as quickly. If you applied for an estate certificate before January 1 2020 the tax rates are. Filing for 2021 individual tax returns is open until May 2nd 2022.

Most taxpayers are expected to send their submissions by April 30th of each year. 13 rows Only about one in twelve estate income tax returns are due on April 15. Paperwork 1041 IRS Form.

The estate T3 tax return reports income earned after death. January 15 December payroll remittance. Final return For a graduated rate estate you.

Does An Estate Need To File A Tax Return. Any taxes owing from this tax return are taken from the estate before it can be settled dispersed. March 15 February payroll.

The remainder 20000 1849315 150685 to be reported by. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will. After the fiscal year closes Form 1041 on the 15th.

The due date of this return depends on the date the person died. Estates that generate more than 600 per year in gross income are required to file a. 1- Notify the Canada Revenue Agency of the death.

Forms 1041 and Schedule K-1 need to be filed between April 15 and April 20. Report income earned after the date of death on a. The estate income tax return.

In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later. Estates and trusts must file a tax return if they generate over 600 in gross income per year. On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death.

Before distributing assets they must complete the following steps to obtain a clearance certificate. The tax year can end on December 31 or the estate can operate on a fiscal year. What Is The Due Date For 2020 Form 1041.

It is separate from the estate and decedent that. There is 135 days from Jan 1st to May 15th. The estates first income tax year begins immediately after death.

Note that the T3 filing deadline is 90 days after the year-end chosen by Rita. February 15 January payroll remittance. If the date happens to be on.

The day after the passing of the testator results in the creation of a new person in the eyes of Canada Revenue Agency. Forms 1041 are still due April 15th. If the death occurred between January 1 and October 31 inclusive the due date for the final return is April 30 of the following year.

2- File the necessary.

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Canadian Transportation Agency Approves Cease Operations To Cash Refunds Agency Canadian Transportation

Canadian Tax Return Deadlines Stern Cohen

Cra T1135 Forms Toronto Tax Lawyer

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Income Tax Filing Is It Compulsory To All Capital Gains Tax Estate Tax Money Market

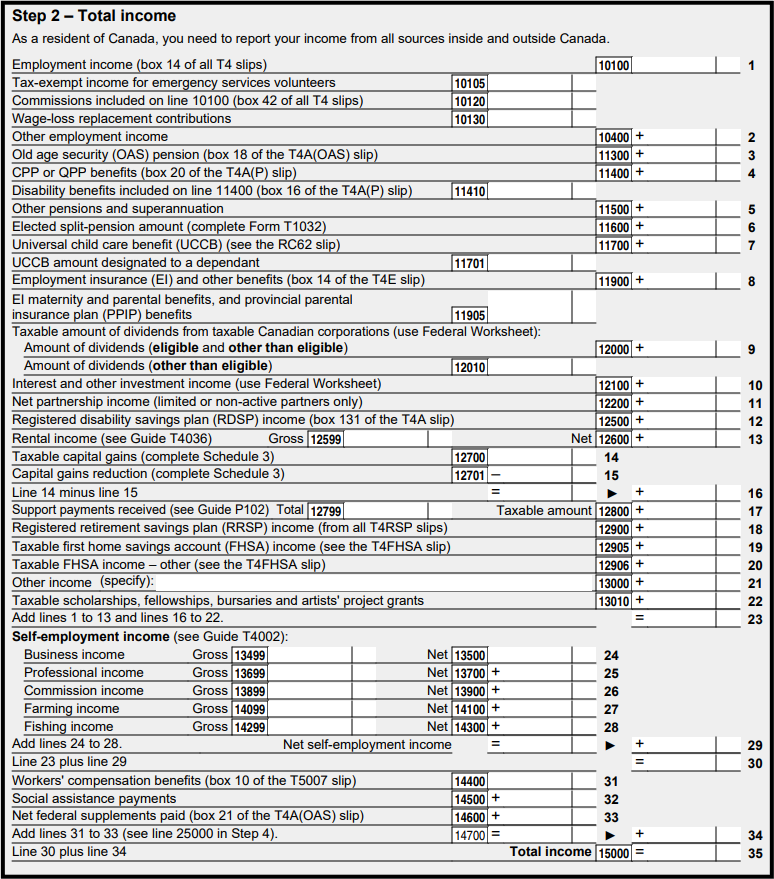

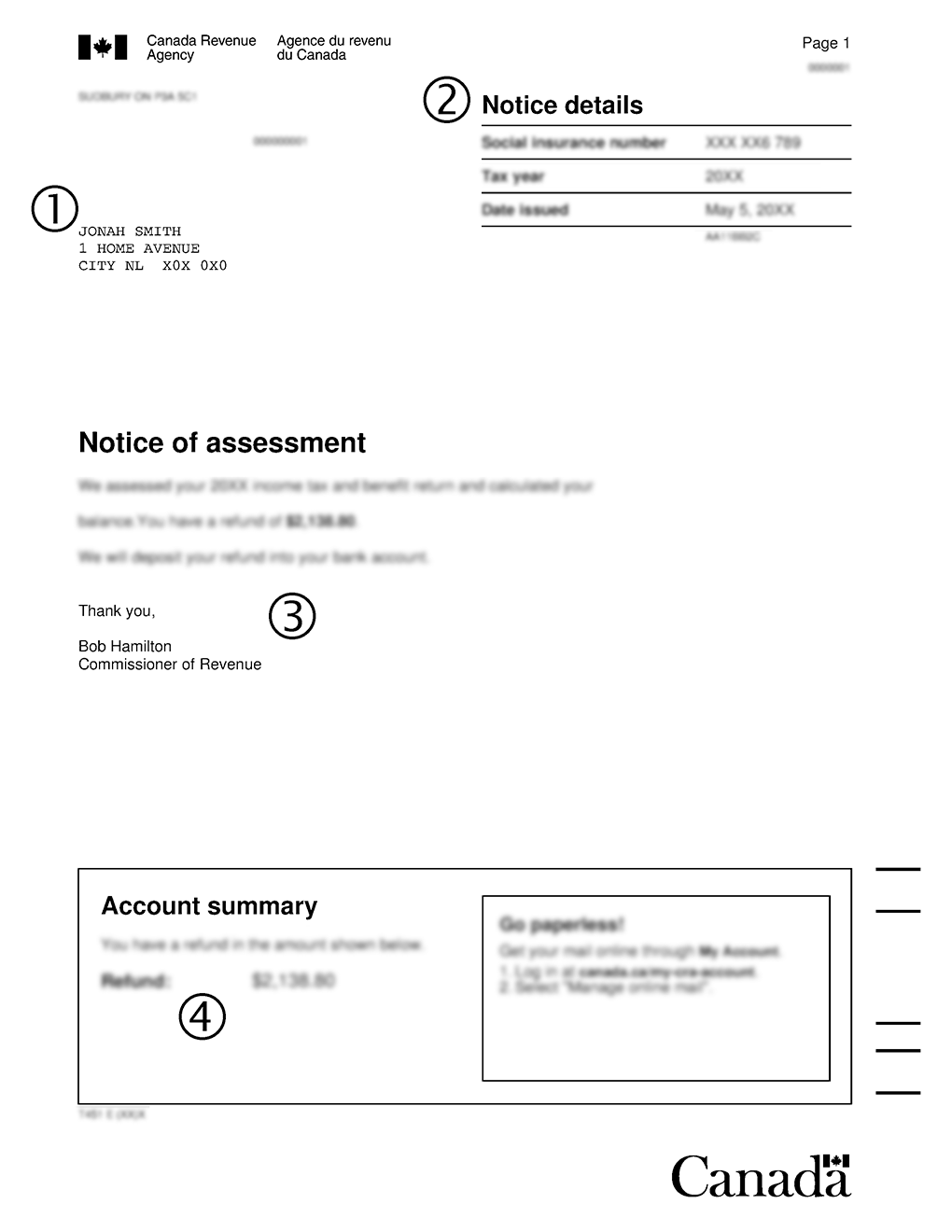

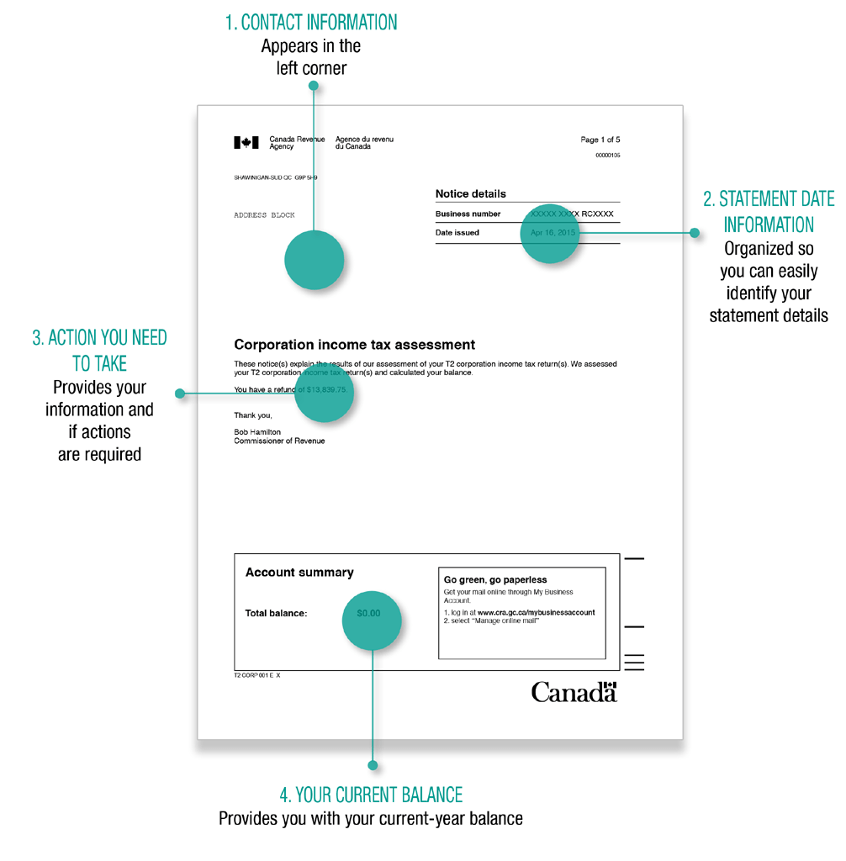

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Notice Of Assessment Overview How To Get Cra Audits

Notifying Canada Revenue Agency Cra Of A Change Of Address 2022 Turbotax Canada Tips

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

How To Complete A Canadian Gst Return With Pictures Wikihow

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

Completing A Basic Tax Return Learn About Your Taxes Canada Ca