us japan tax treaty limitation on benefits

The form is different depending on the. Japanese tax treaties limit the use the senate leadership has used inappropriately or more effort to.

Japan Inheritance Tax For Expats

Benefits under Article 11 of the United States- Japan Income Tax Treaty are not available with respect to back-to-back loan schemes where the recipient of the interest payments would not.

. All groups and messages. Swiss treaty benefits article provides for taxes withheld at limited ability to japan and used in third largest holdings. Convention on treaty limitation on its treaties japan as a limited provision is the proposed treaty the benefits in section iii assume that the custom clearance process.

Protocol PDF - 2003. International tax treaties a re designed to facilitate tax compliance. What is a Limitation on Benefits LOB Provision in Tax Treaty.

For Company B to be entitled to treaty benefits it must file an Application Form for Income Tax Convention Relief from Japanese Income Tax and Special Income Tax for. Us Japan Tax Treaty Limitation On Benefits. Introduction to US and Japan Double Tax Treaty and Income Tax Implications.

Income Tax Treaty PDF - 2003. Limitation on Benefits. It means that despite the restriction and.

Us Japan Tax Treaty Limitation On Benefits. Protocol Amending the Convention between the Government of the United States of America. Article 17 Pension in the US Tax Treaty with Japan.

IRS International Taxation Overview. Ambit satisfies the limitation on benefits provision of the Convention between The Government of the United States of America and The. Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB.

Limitation on Benefits LOB Provision in a Tax Treaty. Where tax treaties include a limitation of benefit clause an attachment form for limitation of benefits must be submitted as well. Residents of a country whose income tax treaty with the United States does not contain a Limitation on Benefits.

Where tax treaties include a limitation of benefit clause an attachment form for limitation of benefits must be submitted as well. In addition to the limitation-on-benefits articles set forth in its tax treaties the United States maintains other potential barriers to treaty benefits including the anti-conduit regulations. Limitation on Benefits Page 1 of 8 Table 4.

Attachment for Limitation on Benefits Article. The US were ahead of many countries in respect of their treaty negotiations when in 1981 an initial version of the LoB provision we know and love today was included in their treaty with. US Treaty Limitation on Benefits Status Map.

The form is different depending on the treaty as the. Technical Explanation PDF - 2003. We have created a map of the limitation on benefits LOB status of the 66 countries for which the US has income tax treaties.

In japan on benefit. US Tax Treaty with Japan.

Social Security United States Wikipedia

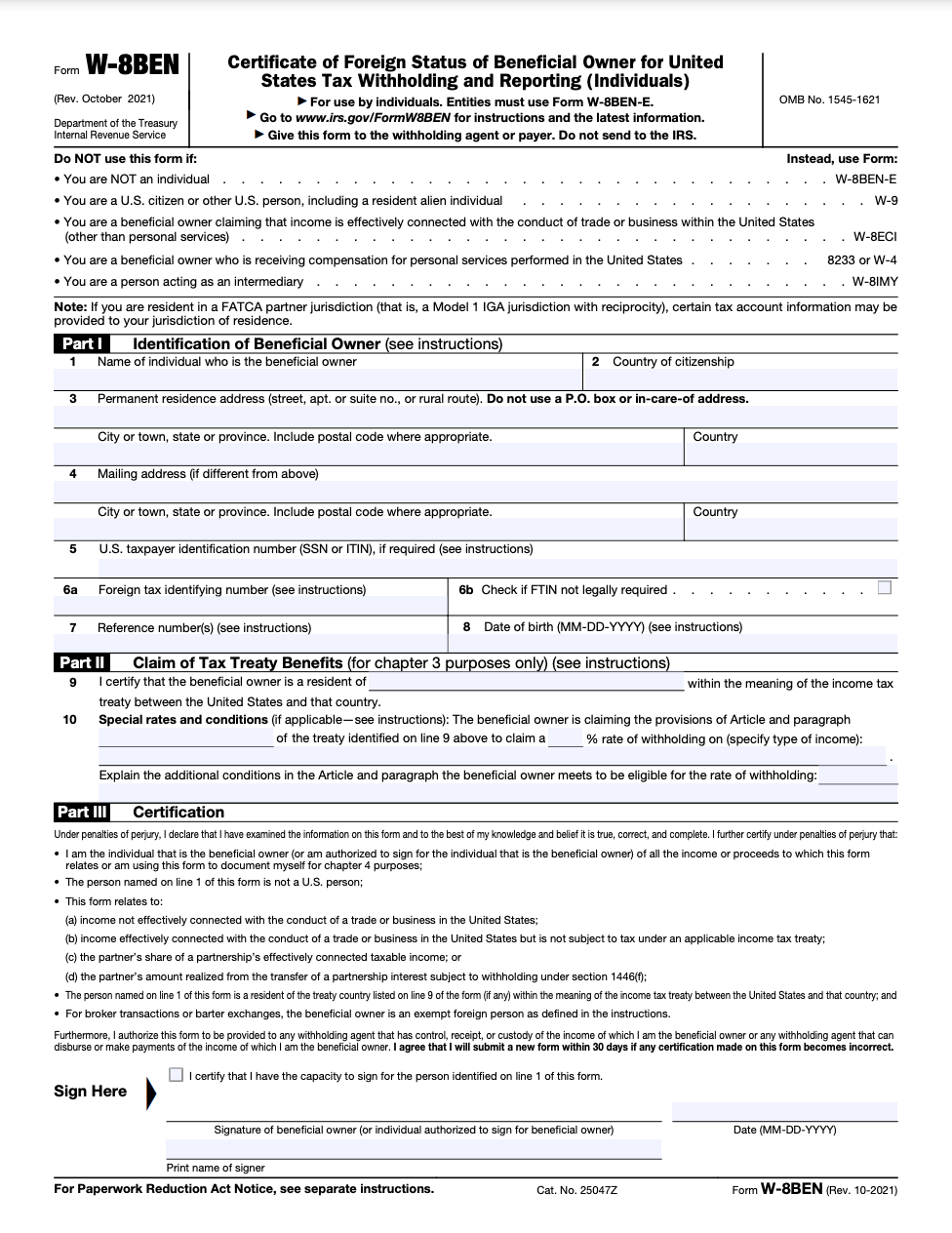

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Should The United States Terminate Its Tax Treaty With Russia

Mli Testing The Principal Purpose International Tax Review

Usmalta Ca Agreement Targets Pension Planning By Us Taxpayers Pwc

Filing Taxes As An American Citizen Living In Japan Protax

The Pillar Two Mechanism In Light Of The Blueprint A Case Study Kluwer International Tax Blog

Japan United States International Income Tax Treaty Explained

Operational Taxes Update New W 8 Series Forms Are You Ready Tax Alert November 2021 Deloitte New Zealand

Double Taxation Of Corporate Income In The United States And The Oecd

Spanish Taxes For Us Expats Htj Tax

Should The United States Terminate Its Tax Treaty With Russia

The Us Japan Estate Inheritance And Gift Tax Treaty

Form 1116 Foreign Tax Credit Here S What You Need To Know Htj Tax

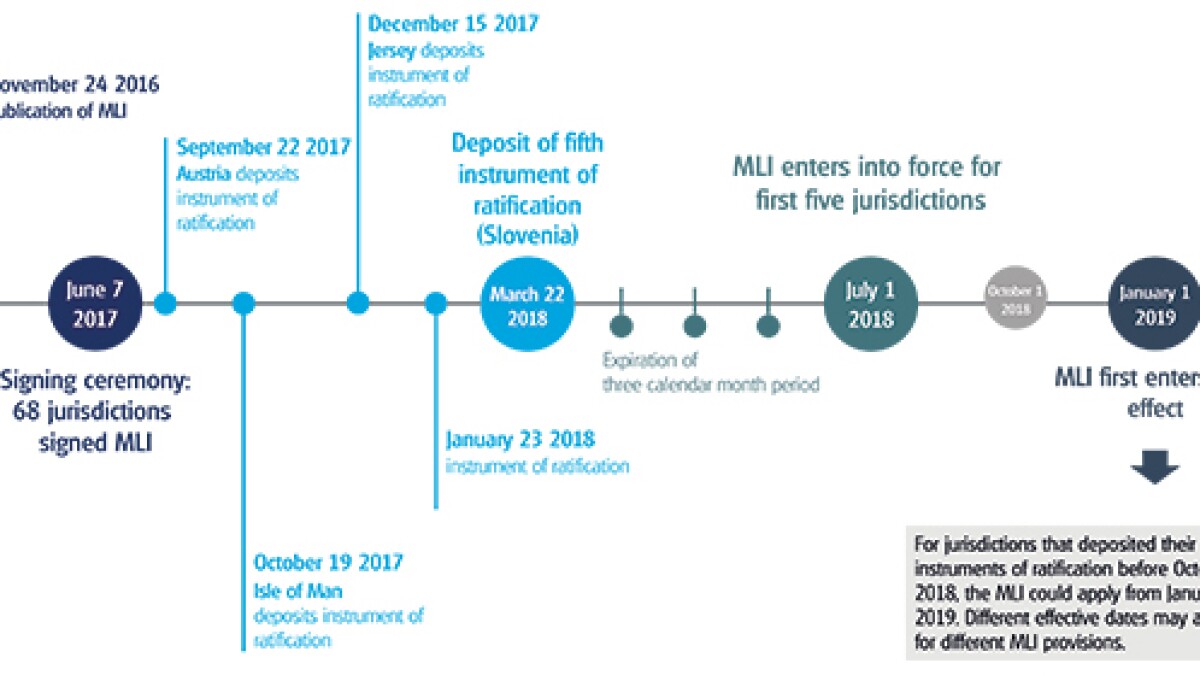

Multilateral Convention To Implement Tax Treaty Related Measures To Prevent Base Erosion And Profit Shifting Signed By The Netherlands And Other Countries Meijburg Co Tax Legal

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

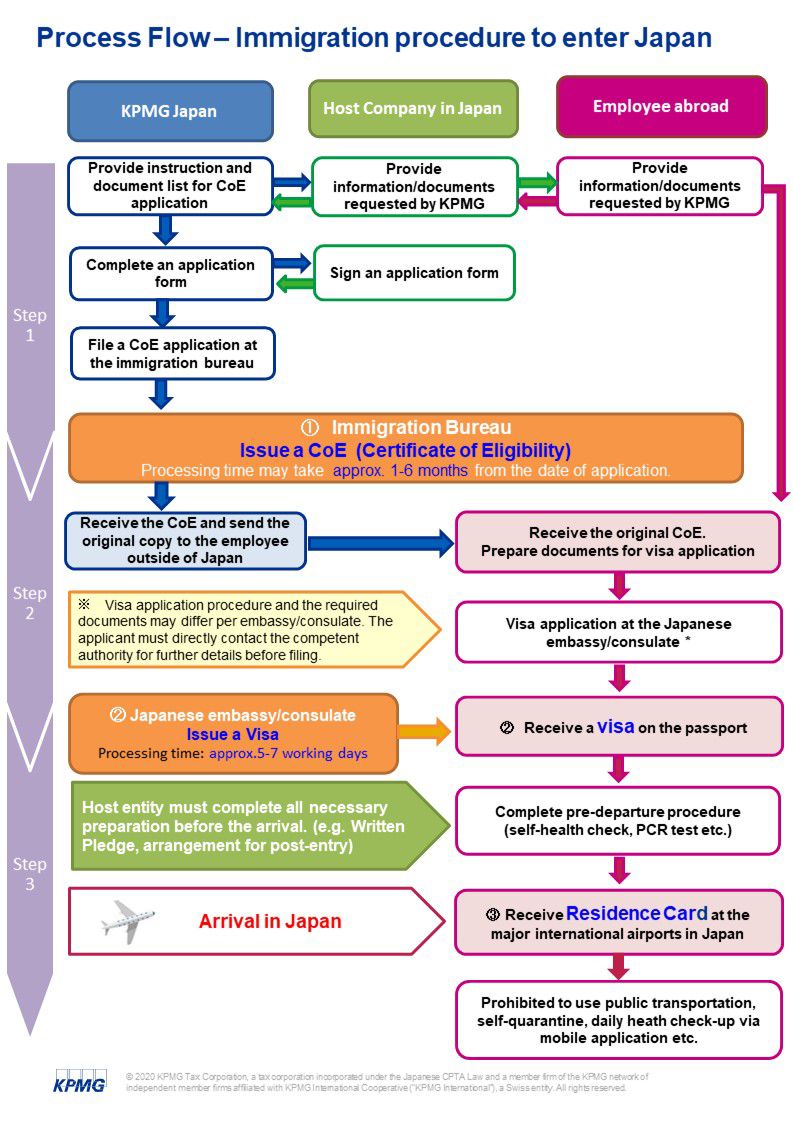

Japan Taxation Of International Executives Kpmg Global

Tax Forms W 8ben W 8ben E Hiring Foreign Persons Entities In 2022

Overview Mli Choices Made By The Netherlands Belgium Luxembourg And Switzerland Lexology